https://samtoa.de/wp-content/uploads/2024/02/Bild1.jpg

321

482

Kirsten Springer

https://samtoa.de/wp-content/uploads/2020/10/samtoa-license-experts-logo.svg

Kirsten Springer2024-02-21 10:36:142024-02-21 16:33:29SAM tools: How do you create acceptance in the company

https://samtoa.de/wp-content/uploads/2024/02/Bild1.jpg

321

482

Kirsten Springer

https://samtoa.de/wp-content/uploads/2020/10/samtoa-license-experts-logo.svg

Kirsten Springer2024-02-21 10:36:142024-02-21 16:33:29SAM tools: How do you create acceptance in the companyContract negotiations with SAP are never easy. In most cases, SAP has a monopoly position, because you as a customer rarely have an alternative. If 50 new SAP user licenses are needed, I can only get them from SAP (or via an SAP partner).

This makes it difficult to achieve negotiation success. Most of the time you are already happy if the standard discount is granted. Furthermore, SAP sales can only be accommodating if more or something different is bought than you actually wanted. “You want user licenses? Then why don’t you subscribe to SAP Concur and get a special discount on user licenses.”

In the following, I will describe for various situations which points need special attention in contract negotiations in order to achieve the best possible agreements. “Best possible” does not only mean to get low prices, but to be able to react flexibly in the future or to have eliminated unclear regulations.

Subsequent purchase (purchase of additional quantities)

The metrics of SAP products are often only very imprecisely defined. Every subsequent purchase offers an opportunity to make improvements here. Insist on an understandable and unambiguous and clear definition in the post-purchase contract. This includes

- What is being measured?

For example, with the metric “spend volume”: does the spend volume of the entire group count, that of the legal unit in which the product is used, or only the volume that is processed via the product? The

same ambiguities often exist with the metrics “Employees” or “Revenue”.

- How is it measured?

The contract should clearly specify the basis for measurement. In the past, SAP has often unilaterally changed the calculation method. If the measurement details are regulated in the contract, subsequent changes must be agreed in writing.

- What happens when the metric changes?

I have often experienced that a customer had purchased a product at different times with different metrics, e.g. with “User” metric and later with “Number of Objects”. Such situations should already be regulated at the initial purchase, e.g. that subsequent purchases in the same metric must be possible indefinitely. When voluntarily switching to the new metric, the licensed volume of the old metric must be converted in such a way that the same business benefit can be achieved without additional costs. I.e., if I was able to process 10,000 objects per year with 50 users in the past, I must be able to get at least 10,000 objects for my old licenses in the new metric – regardless of the price.

Additional purchases (purchase of new products)

Here, too, the same applies initially as with the subsequent purchase. The ambiguities must be eliminated contractually.

In addition, the following points should be noted:

- “roll-out agreements

In the rarest of cases, the entire license quantity is required when the contract is signed. SAP product launches often take 1-2 years. If the full quantity is licensed right at the beginning, maintenance must already be paid for – without receiving any value in return. Roll-out agreements with fixed dates are also not ideal, as projects tend to be delayed. Try to tie the purchase date in the contract to project milestones.

- Safeguarding the future

Long-time SAP customers know the situation: A product that has been purchased is removed from the price list. In exchange, there is a successor product that also has some other features. In these cases, SAP would like to have the total quantity re-licensed for subsequent purchases. After all, it is a new product. When signing a contract, you should secure the right to switch to successor products free of charge.

Shutdown

The right to decommission unused products must be included in every contract. Otherwise you are dependent on SAP agreeing to this – will this be done without consideration?

In addition to tracking down products that are no longer in use, you should also regularly check whether the products that were once licensed are still in the price list at all. If not, it may be that the functionality is now included in other products (e.g. “Records Management” is now included in the Netweaver license). This makes the purchased licenses unnecessary. Without decommissioning, you continue to pay maintenance for something that no longer exists as a product.

With a decommissioning one reduces the maintenance costs, but the investment value of the product is lost. It is therefore worth checking the SAP extension policies. Sometimes shelfware can be credited when purchasing new products.

Cloud Contracts

SAP sees the future in the cloud. The profit margins in this area are too lucrative. Admittedly, this architecture also offers advantages for SAP customers. But beware, we are talking about completely new contract forms with new GTCs. It is worthwhile to deal with these.

Cloud T&Cs:

Some excerpts:

- “SAP shall be entitled to verify the contractual compliance of the use of the Cloud Service, in particular the compliance with the agreed usage metrics and volumes. “

- “SAP shall have the non-exclusive right to use Customer Data … to verify Customer’s compliance with the provisions of Section 2. “

In this way, SAP secures access to all of the customer’s data in the cloud applications as long as it is used for license verification. Gone are the days when the customer could determine for himself at what point in time which data was made available. SAP can check the correct licensing at any time and directly request relicensing.

If you accept this regulation without restriction, you force yourself to permanently monitor the use, to delete inactive accounts, to sensitize employees, to use new functions only after consultation.

Contract Amendments:

With cloud contracts, you only acquire a temporary right of use, unlike the classic on-premise licenses. This makes a big difference. At the end of the term, either the usage ends or you have to sign a renewal contract. SAP can completely redefine the terms of the contract at that time. Extensive changes (functionality, metrics, price) are possible with each contract renewal. Since you have already invested heavily in the product launch, you have little opportunity to object to this.

Vendor lock-in

Mapping business-critical processes in cloud applications leads to a high level of commitment to the provider. Even with on-premise installations of SAP, switching to another provider is lengthy, risky and expensive. In the cloud, you lose the ability to access your data when the contract is terminated. A lot of data has to be kept for a long time for legal reasons. I.e. you would also have to transfer all historical data to a new environment. You would have to continue paying for the old cloud application for the entire migration period. This increases your dependency on the provider.

It is important to think about what happens if you terminate the contract when you sign it. In this case, you should find creative solutions, for example:

- You can try to contractually oblige SAP to support a complete data export.

- Reduced subscription fees can be agreed for a possible migration period.

Rise With SAP

What does “Rise with SAP” consist of?

With “Rise with SAP”, SAP wants to boost its cloud business. Software licenses, cloud infrastructure and services are bundled under one contract (with SAP).

In detail, these components are part of a “Rise with SAP” contract:

- Migration tools

- S/4HANA Cloud

- Business Technology Platform

- SAP Business Network Starter Pack

- Ariba Business Network (<= 2000 purchase orders or invoices)

- Asset Intelligence Network

- Logistics Business Network

- Business Process Intelligence Starter Pack

- SAP Process Insights: 50 GB with one-time load only

- SAP Signavio Process Manager: 3 users

- SAP Signavio Process Collaboration Hub: 10 users

- Full Use Equivalents (user licenses)

- SLA, support and operation contracted from one partner

What is to be paid attention to?

First, Rise with SAP is a cloud contract. Thus, all the points of the previous chapter apply.

For all components you have only one contractual partner – SAP. This means you no longer have the option of negotiating with different infrastructure providers or service providers. This gives SAP an even stronger monopoly position. On the other hand, this makes negotiations easier for you.

The two included Starter Packs must be evaluated as a freemium model. The limited scope of use can be used to try out the tools. For serious use in the company, additional licenses must be purchased.

The “Full-Use-Equivalents” are a flexible way to use user licenses for different user types. With a “Rise with SAP” contract, you do not have to define the relationship between the different user types. However, the definition of the user types is different from other SAP user price lists. This makes it difficult to determine the number of “full-use equivalents” required. You should not rely on SAP estimates here. You as the customer remain responsible for the correct licensing.

With a “Rise with SAP” contract, you also license “Digital Access”, the license model for indirect access to SAP functions. You should be aware that all interfaces from non-SAP systems that create data in SAP must then be licensed according to the number of line items created.

This also applies to all documents that are created with your own developments using the Business Technology Platform.

Contractually, “Digital Access” represents a major challenge, as only very vague estimates are possible as to the extent to which royalty-bearing receipts will arise. To avoid incalculable risks, you should anchor cost limits in the contract.

S/4HANA contract migration

SAP’s new core product is S/4HANA. The predecessor software SAP R/3 or SAP ECC is only in standard maintenance until 2027. By 2030, all SAP customers must have migrated to the new version. Technically, this is a huge challenge. Commercially, the changeover can be made at any time. For the entire migration period, SAP grants its customers a “dual-use right”, i.e. the new S/4HANA license may also be used if I am still working in ECC. Basically, SAP existing customers have two options to carry out the migration commercially:

- product conversion

The “Product Conversion” is initially uncritical. With a small fee of € 9,000, SAP grants you the right to transfer all previously acquired usage rights into the S/4HANA world.

Engines for which there are successor products in S/4HANA can be exchanged individually. In doing so, the license prices paid are credited 100% towards the purchase of the new products.

You can also perform a contract consolidation as part of a “product conversion” to clean up the contract history and create better transparency.

We recommend that you take into account the proposals for additional purchase, additional purchase and decommissioning. This will give you more clarity and security with the new contract.

- contract conversion

With the “Contract Conversion” all old contracts with SAP become invalid. A completely new product configuration is compiled from the current price list. All old licenses are credited to the contract price. The terms and conditions of the S/4HANA products apply to the new contract, even if you are still working in ECC. It is therefore essential to check in which points there are changes. This may concern the scope of functions, metrics or usage restrictions.

In the case of a “Contract Conversion”, SAP only charges the old licenses up to a maximum of 90% of the new contract value. If you do not want to give away any old licenses, the new contract must therefore be at least 11.11% more expensive.

After a “Contract Conversion” there are only 4 new user types (Professional, Functional, Productivity, Developer). Before concluding the contract, you need to check in which configuration the new types are needed. This can be an extensive task as long as you do not use a third party tool.

The contract should also regulate what happens with ECC products for which there is not yet an S/4 successor product. The availability of the successor product can lead to considerable additional costs if this process has not already been regulated in the conversion contract.

With an S/4HANA contract, “Digital Access” is also always an issue. Precautions must be taken here to minimize future risks.

Since a migration to S4/HANA takes a long time, you cannot know conclusively at the beginning which products you will use and to what extent. Therefore, you should agree on a configuration right for the entire duration of the migration.

We also recommend that you consider the proposals for post-purchase, additional purchase and decommissioning in the case of “contract conversion”.

Since SAP wants to make S/4HANA a success story, you can currently negotiate high discounts. You should also secure these for subsequent purchases.

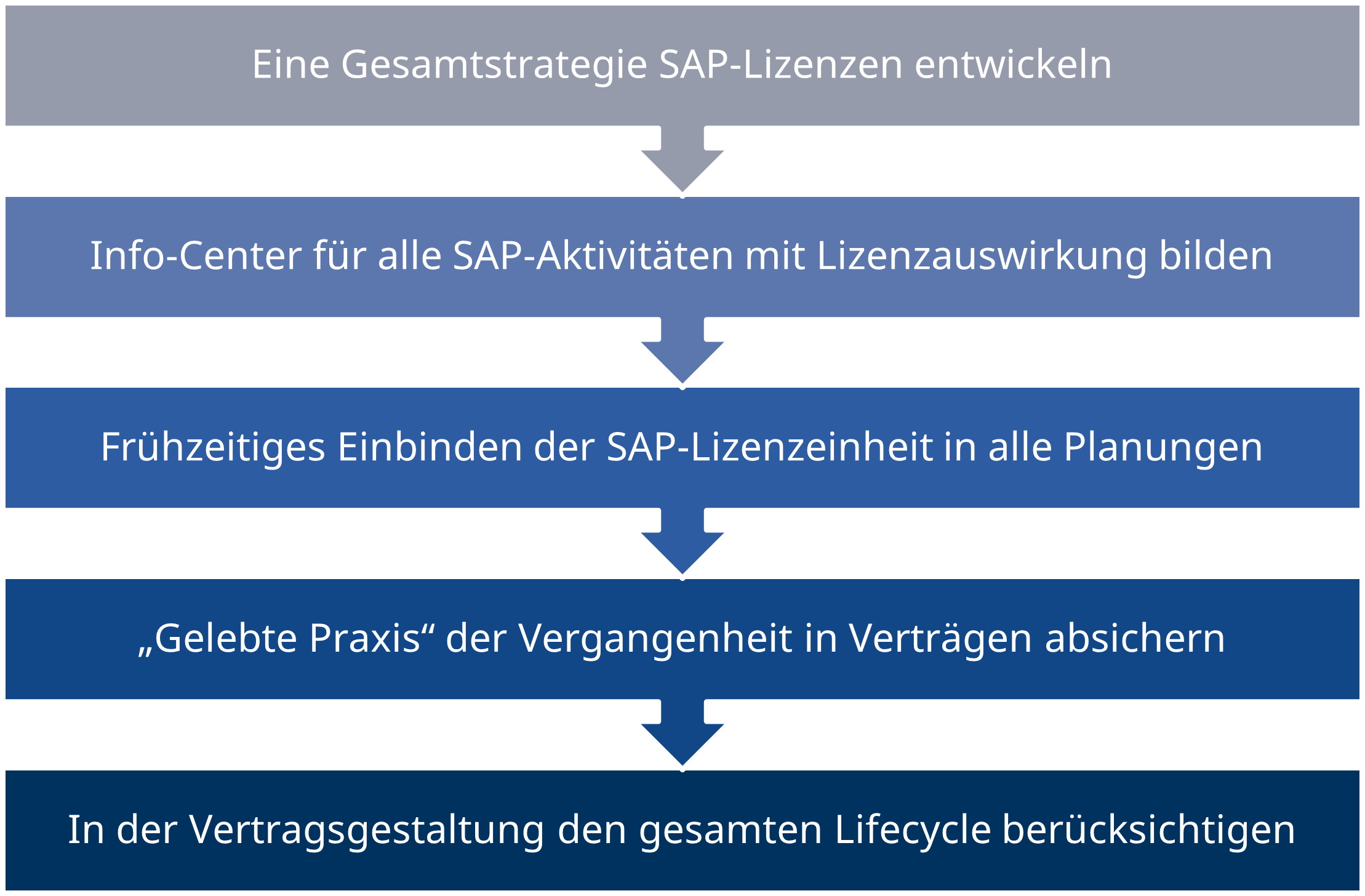

Our recommendation for successful negotiations with SAP:

We are happy to help!

SAMtoa has helped many customers to make good agreements with SAP. With our help, you can reach better agreements with SAP, where ambiguities are eliminated and your interests are protected in the best possible way.

There is the SAMtoa to support you.

Subscribe to our newsletter and you will not miss any more tips!

The Author

Wolfgang Stratenwerth

Managing Director and licensing expert of SAMtoa GmbH

COPYRIGHT Fotos auf Lager von Vecteezy - https://de.vecteezy.com/

COPYRIGHT Fotos auf Lager von Vecteezy - https://de.vecteezy.com/